The Future of Cryptocurrency: Why Investing Now Could Transform Your Financial Future

Cryptocurrency has evolved from a niche digital experiment into a global financial phenomenon. Over the past decade, Bitcoin, Ethereum, and thousands of other digital assets have reshaped how we think about money, investments, and the future of finance. While skeptics still question its staying power, the rapid adoption by institutions, governments, and everyday investors suggests that cryptocurrency is here to stay—and could play a pivotal role in shaping the economy of tomorrow.

In this article, we’ll explore the future of cryptocurrency, its potential benefits as an investment, and why now might be the right time to consider adding digital assets to your portfolio.

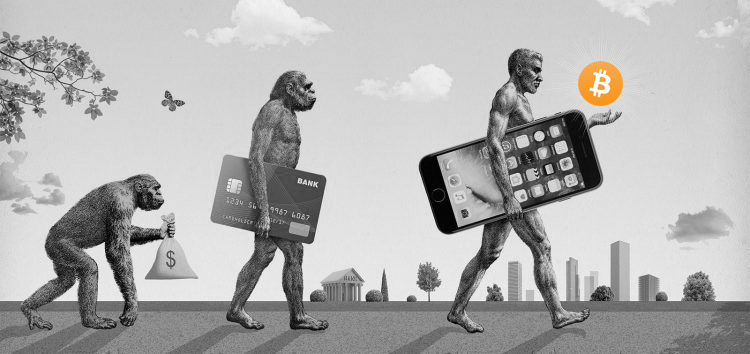

The Evolution of Cryptocurrency: From Bitcoin to Mainstream Adoption

When Bitcoin launched in 2009, it was dismissed by many as a speculative toy for tech enthusiasts. Fast-forward to today, and Bitcoin alone boasts a market cap exceeding 1 trillion, while the broader crypto market has urged past 1 trillion, while the broader crypto market has urged past 2 trillion. What changed?

- Institutional Acceptance: Major companies like Tesla, MicroStrategy, and PayPal now hold Bitcoin on their balance sheets. Financial giants like BlackRock and Fidelity offer crypto investment products.

- Regulatory Clarity: Governments are increasingly creating frameworks to regulate crypto, signaling legitimacy (e.g., the EU’s MiCA legislation, U.S. spot Bitcoin ETFs).

- Technological Innovation: Blockchain technology underpinning crypto has expanded beyond payments to power decentralized finance (DeFi), smart contracts, NFTs, and more.

These developments suggest that crypto is transitioning from a speculative asset to a foundational component of the digital economy.

The Benefits of Investing in Cryptocurrency

While crypto is volatile, its unique advantages make it an appealing addition to a diversified portfolio. Here’s why:

1. Decentralization and Financial Freedom

Cryptocurrencies operate on decentralized networks, free from government or bank control. For investors in countries with unstable currencies or restrictive financial systems, crypto offers a lifeline to preserve wealth and transact globally without intermediaries.

2. High Growth Potential

Despite market cycles, crypto has historically delivered outsized returns. Bitcoin, for example, has grown over 10,000% in the past decade. Emerging projects in DeFi, AI-blockchain integration, and Web3 could drive similar growth in the future.

3. Portfolio Diversification

Crypto often behaves independently of traditional markets like stocks and bonds. Adding even a small allocation (e.g., 1–5%) can reduce overall portfolio risk through diversification.

4. Accessibility and Inclusion

Unlike traditional investments, crypto markets operate 24/7 and require no minimum investment. Platforms like Coinbase or Binance allow anyone with an internet connection to participate, democratizing access to wealth-building opportunities.

5. Innovation-Driven Value

Blockchain technology is revolutionizing industries.

- DeFi: Earning interest, borrowing, or trading without banks.

- NFTs: digital ownership of art, music, and collectibles.

- Smart Contracts: Automating agreements (e.g., insurance, real estate).

Investing in crypto means backing the innovators building these solutions.

The Challenges: Risks Every Investor Should Know

Crypto isn’t without risks. Before investing, consider these factors:

- Volatility: Prices can swing dramatically in hours. Bitcoin has seen 80% drops in past bear markets.

- Regulatory Uncertainty: Governments could impose restrictions affecting prices (e.g., China’s 2021 crypto ban).

- Security Risks: Hacks, scams, and lost passwords have cost investors billions. Always use secure wallets and exchanges.

- Market Immaturity: Many projects fail. Research is critical to avoid “pump and dump” schemes.

Mitigate these risks by investing only what you can afford to lose, diversifying across assets, and sticking to established projects like Bitcoin and Ethereum.

The Future of Crypto: Trends to Watch

What’s next for cryptocurrency? Here are five trends shaping its future:

1. Institutional Adoption Accelerates

Wall Street is embracing crypto. BlackRock’s spot Bitcoin ETF approval in 2024 opened the floodgates for retirement funds, hedge funds, and pensions to enter the market. This influx of capital could stabilize prices and reduce volatility.

2. DeFi and Real-World Use Cases

Decentralized finance platforms (e.g., Uniswap, Aave) are enabling lending, trading, and earning interest without banks. As DeFi becomes user-friendly, it could disrupt traditional finance.

3. Regulatory Collaboration

Governments are increasingly working with crypto firms to create balanced regulations. Clear rules will attract more investors while curbing fraud.

4. Central Bank Digital Currencies (CBDCs)

Over 100 countries are exploring CBDCs—digital versions of national currencies. While centralized, CBDCs could bridge the gap between traditional finance and crypto.

5. Sustainability Innovations

Critics often highlight crypto’s energy consumption (e.g., Bitcoin mining). However, newer blockchains like Ethereum 2.0 use eco-friendly “proof-of-stake” systems, and renewable energy solutions are gaining traction.

Why Now Might Be the Right Time to Invest

Crypto markets are cyclical, with periods of explosive growth followed by corrections. While timing the market is nearly impossible, here’s why the current landscape favors long-term investors:

- Post-Bear Market Opportunities: After the 2022 downturn, prices remain below all-time highs, offering potential upside.

- Technological Maturity: Blockchain projects are solving real-world problems, from supply chains to healthcare.

- Global Macro Trends: Inflation, geopolitical tensions, and currency devaluation are driving demand for decentralized assets like Bitcoin.

How to Start Investing Responsibly

- Educate Yourself: Understand blockchain basics, market cycles, and project fundamentals.

- Choose Reputable Platforms: Use regulated exchanges (e.g., Coinbase, Kraken) and cold wallets (e.g., Ledger) for storage.

- Diversify: Allocate across blue-chip coins (Bitcoin, Ethereum) and smaller projects with strong use cases.

- Think Long-Term: Avoid emotional decisions. Crypto is a marathon, not a sprint.

Conclusion: Crypto’s Role in the Future of Finance

Cryptocurrency is no longer a fringe experiment—it’s a transformative force reshaping money, ownership, and trust. While risks remain, the potential rewards for early adopters are significant. From decentralized finance to global financial inclusion, crypto’s innovations are unlocking opportunities that were unimaginable just a decade ago.

For investors willing to embrace volatility and stay informed, cryptocurrency offers a chance to participate in the next chapter of financial history. Whether you’re hedging against inflation, diversifying your portfolio, or supporting groundbreaking technology, the future of crypto is bright—and it’s just getting started.

Here is a new AI tool that can help you fund manage automatically. Learn More

Disclaimer: This article is for informational purposes only and not financial advice. Cryptocurrency investments carry risks; always conduct your own research or consult a financial advisor before investing.